Table of Contents

Toggle

In recent years, the business of owning a sports franchise has shifted from vanity project to strategic asset class. Few individuals understand that transformation better than Marc Lasry, a billionaire investor with a history of making timely bets in finance and sports. His views on the evolving economics of professional teams came into sharper focus during a recent interview, where he discussed the dynamics that make ownership more than just a scoreboard game.

As valuations skyrocket and media rights redefine revenue streams, investors are paying attention. His own experience, including his profitable exit from the Milwaukee Bucks and reported bid for a stake in the New York Giants, places him among the foremost figures reshaping the narrative around sports as investment. His observations help decode why franchises are no longer just brands—they’re now offer significant return on investment.

The New Economics of Team Ownership

Professional sports franchises have become multi-billion-dollar enterprises. Lasry’s experience underscores how this trend developed and where it might lead next.

Rising Valuations Show No Sign of Slowing

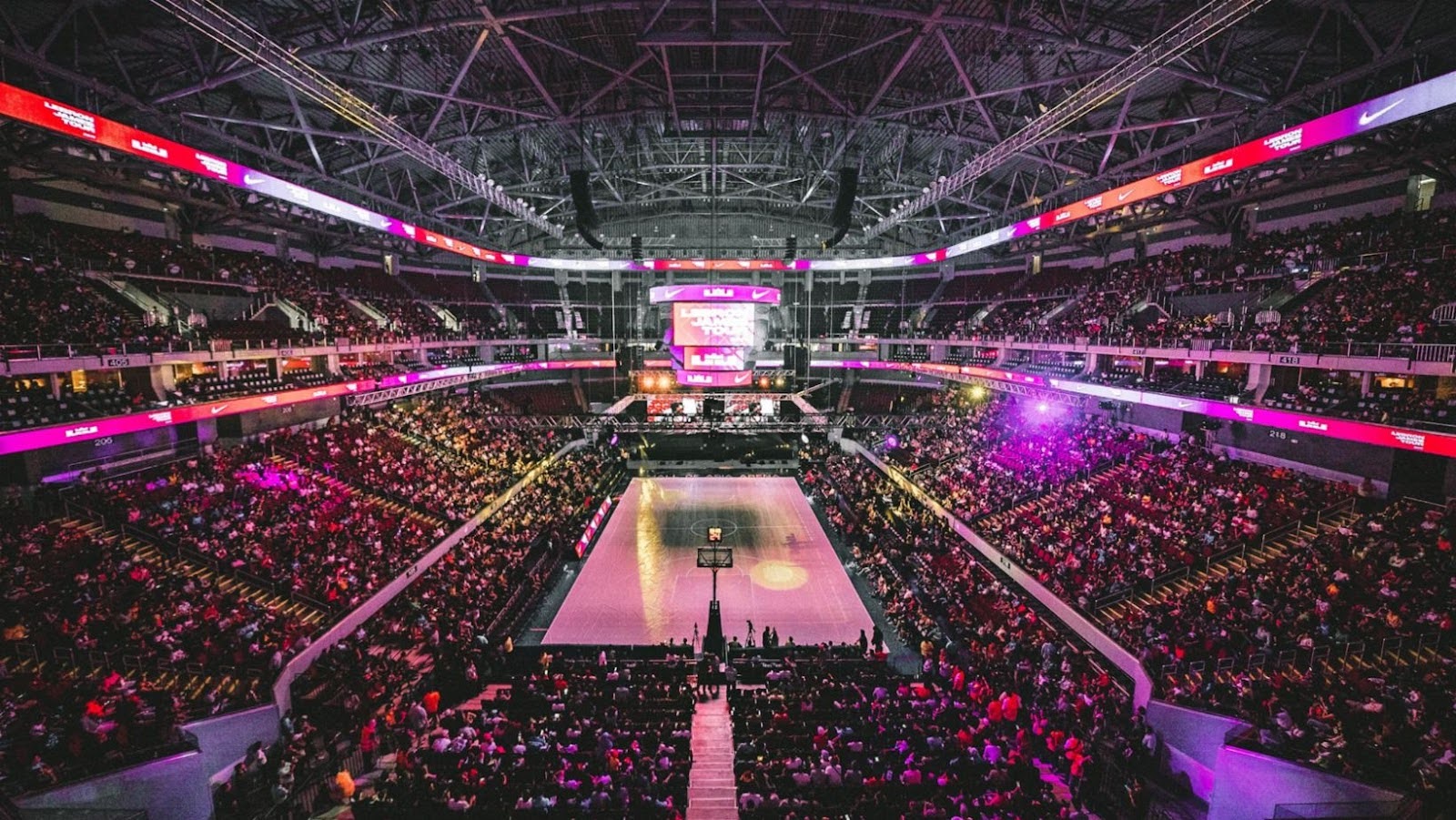

In March 2025, the Boston Celtics were reportedly sold in a deal that valued the team at over $6.1 billion, shattering previous NBA franchise records. This deal was not an isolated event. Instead, it affirmed a broader trend: the consistent appreciation of elite sports properties.

When Lasry and his partners sold their stake in the Milwaukee Bucks at a $3.5 billion valuation in 2023, after purchasing the team for just $550 million in 2014, it validated the proposition that strategic ownership could yield enormous upside. These kinds of deals are changing how institutional capital evaluates sports teams. Once considered illiquid and unpredictable, they are now being viewed as long-term, inflation-resistant holdings with built-in cultural cachet.

Performance and Culture Drive Long-Term Value

During his recent interview, Lasry emphasized that owning a team isn’t simply about buying into a league. Instead, it’s about building a winning organization. While talking to Bloomberg, he noted that performance on the court or field affects not only ticket sales and merchandise but also media exposure, sponsor interest, and brand equity.

A team with a strong internal culture, clear leadership, and a sustainable performance model becomes more attractive to both fans and business partners. Success isn’t limited to winning championships, franchises can thrive financially by remaining consistently competitive and investing in talent development. More investors now recognize that owning a team closely resembles running a mid-sized company, where recruiting talent, nurturing culture, and executing long-term strategy are essential to lasting success.

Diversified Revenue Streams and Investor Appeal

Franchises today generate income from a myriad of sources aside from game-day tickets. This evolution is what makes them attractive to figures like Lasry and other seasoned investors.

Media Rights and Streaming Have Changed the Game

Traditional revenue from gate receipts has been supplemented—and in many cases surpassed—by media rights deals. National and international contracts now make up a growing share of each franchise’s income, offering owners consistent and scalable returns. With leagues like the NFL and NBA expanding their global streaming reach, teams now operate as both entertainment brands and content engines.

This trend was outlined clearly in the recent Marc Lasry value of pro teams building interview on Bloomberg, where he emphasized how sports franchises are evolving into high-yield media platforms. Lasry noted that future value won’t come from ticket sales alone but from content delivery, on-demand streaming, and direct-to-consumer experiences. These elements give teams an edge, offering unmatched visibility, engagement, and recurring revenue.

Sponsorship, Licensing, and Real Estate Development

Beyond broadcast rights, franchises increasingly derive income from what many might see as non-core business activities. Stadium naming deals, merchandise licensing, and venue development contribute to a franchise’s asset profile. In some cases, franchises act as real estate anchors that help revitalize entire districts.

Investors like Lasry look for these layers. A team is no longer just a sports product—it’s a brand portfolio. From co-branded products to premium seating experiences, ownership allows access to diversified consumer markets and commercial property strategies. That’s an unusual but powerful combination for long-term investors seeking recurring returns and equity growth.

Strategic Partnerships Are Reshaping Ownership Models

The traditional ownership group of a sole wealthy individual is being replaced by strategic alliances. Lasry’s next move appears to follow that model.

Teaming Up With Influential Co-Investors

He is reportedly partnering with Michael Strahan in a bid for a minority stake in the New York Giants, one of the most storied franchises in the NFL. The move reflects a new trend in sports investing, combining financial capital with celebrity equity. These hybrid groups not only inject funds but also bring branding power, public relations clout, and strategic media access.

The Giants’ deal is part of a broader pivot in NFL ownership, where legacy teams are seeking to expand their ownership base without sacrificing control. Lasry’s potential involvement points to how experienced financiers are increasingly welcomed as partners due to their capital discipline and strategic expertise.

Minority Stakes Offer Scalable Entry

While majority ownership remains expensive and scarce, minority stakes are now seen as viable financial plays. They allow for exposure to a team’s upside without taking on full operational control. Marc Lasry’s interest in a minority stake reflects that logic. For investors, it’s a way to participate in asset growth, revenue sharing, and brand building—without the burden of front-line management.

It also shows how sports leagues are adapting. By offering minority shares to sophisticated investors, franchises can unlock liquidity while maintaining long-term stability. That’s a win for both capital and culture.

Why the Sports Investment Trend Isn’t Slowing Down

Lasry’s perspective mirrors a growing shift in how high-net-worth individuals and institutional players view sports. They’re not just passion projects anymore—they’re scalable financial ecosystems.

The Emotional Hedge: Culture Meets Capital

Owning a sports team gives investors something traditional holdings don’t: community resonance. Teams represent cities, history, and identity. That emotional equity enhances brand durability and creates long-term engagement. Lasry highlights this, noting that teams thrive when they are embedded in their communities.

This mix of financial potential and cultural relevance makes sports teams unique. It’s a sector where emotional connection and smart investing intersect. For individuals managing large portfolios, that blend is rare—and increasingly appealing.

Building a Legacy Beyond the Balance Sheet

In an age where values-driven investing matters, the ownership of sports teams has become a strategic move that aligns with both business logic and brand identity. For Lasry, this shift is less about trend and more about timing—and his track record suggests he knows when the value is real.