Other Companies Like Afterpay

One such company is Klarna, which allows shoppers to split their purchases into four interest-free payments. With a wide range of retail partners and a user-friendly app, Klarna provides an easy and flexible way to manage your shopping expenses.

Another notable player in the buy now, pay later space is Affirm. Like Afterpay, Affirm allows customers to divide their purchases into manageable installments without any hidden fees or compounding interest. With its transparent pricing and seamless integration with online retailers, Affirm has gained popularity among consumers looking for an alternative payment method.

Sezzle is another option worth considering if you’re seeking companies similar to Afterpay. With Sezzle, shoppers can break down their payments into four installments over six weeks, making it an attractive choice for budget-conscious individuals. Plus, Sezzle doesn’t perform hard credit checks or charge any interest on your payments.

Introduction to Afterpay

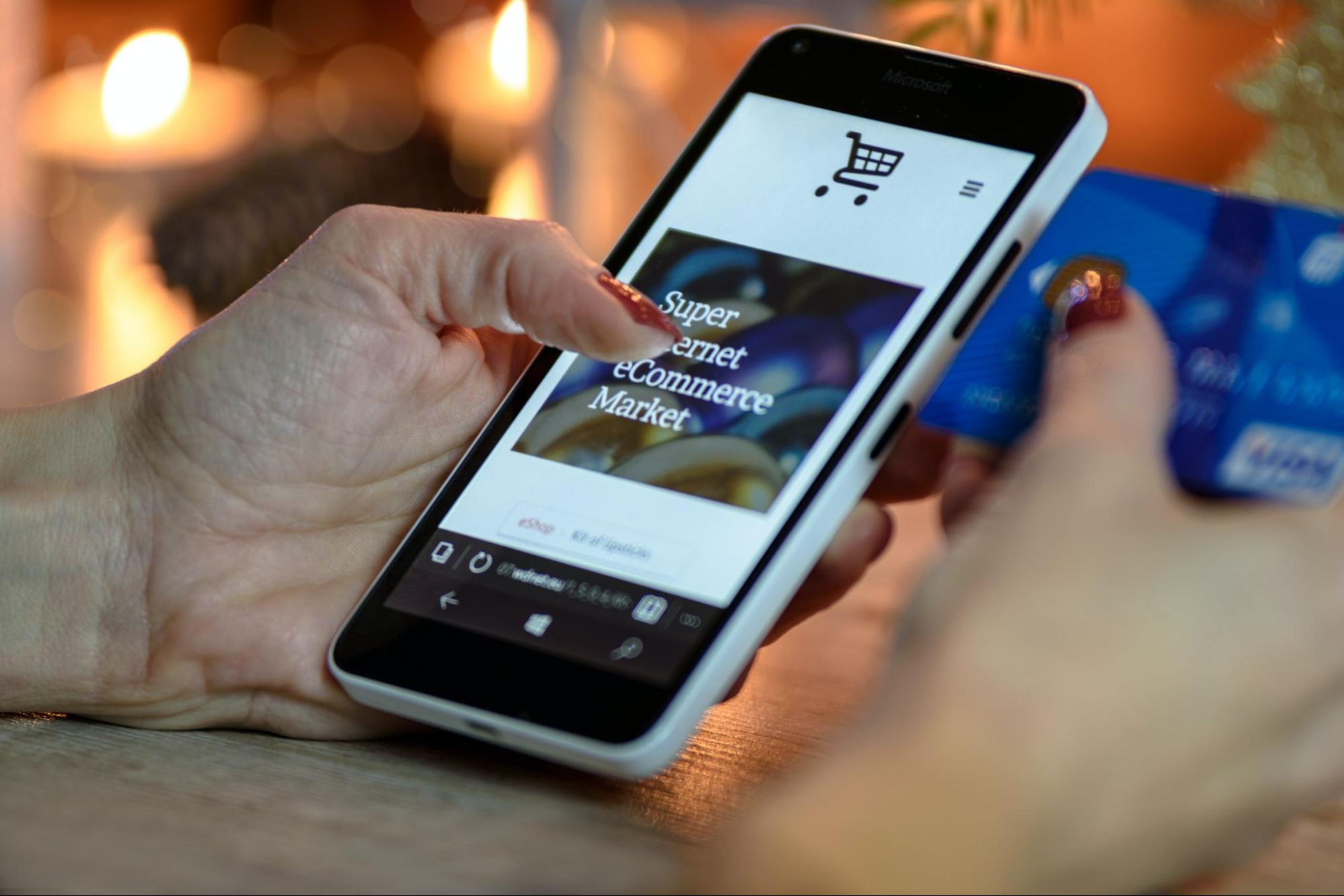

Afterpay, a popular payment platform, has revolutionized the way people shop online. With its innovative “buy now, pay later” model, Afterpay has gained significant traction and transformed consumer spending habits. However, it’s always good to explore other companies like Afterpay that offer similar services.

One of the key aspects that sets Afterpay apart is its commitment to providing a seamless and convenient shopping experience. By offering interest-free installment plans, customers can split their purchases into manageable payments without incurring any additional charges. This feature appeals to budget-conscious shoppers who want flexibility in managing their finances.

Another notable characteristic of Afterpay is its widespread acceptance across various retailers. From fashion brands to beauty products and even travel booking platforms, Afterpay has partnered with numerous merchants to offer its services. This broad network ensures that consumers have ample options when it comes to utilizing the platform for their purchases.

Aside from being user-friendly for customers, Afterpay also benefits businesses by increasing conversion rates and average order values. By integrating with this payment solution, retailers tap into a larger customer base and attract more sales opportunities. This mutually beneficial relationship between merchants and Afterpay contributes to the platform’s success.

Furthermore, what distinguishes Afterpay from traditional credit systems is its emphasis on responsible spending practices. Unlike credit cards that can lead individuals into debt traps if not used wisely, Afterpay encourages users to spend within their means by setting clear repayment schedules upfront. This transparency fosters financial discipline while still allowing customers to enjoy their desired products or services immediately.

Similar Companies to Afterpay

When it comes to other companies like Afterpay, there are a few notable players in the market that offer similar services and benefits. Here are some of the top contenders:

- Klarna: Klarna is a popular buy now, pay later platform that allows customers to split their purchases into interest-free installments. With a wide network of merchants, Klarna provides seamless checkout experiences and flexible payment options.

- Sezzle: Sezzle is another company that operates in the same space as Afterpay. It enables shoppers to make purchases and pay for them over time without any interest or fees. With its user-friendly interface and transparent policies, Sezzle has gained popularity among online shoppers.

- Affirm: Affirm offers an alternative financing solution by providing loans for purchases at checkout. Customers can choose from various repayment plans with fixed interest rates, making it a convenient choice for those looking for flexibility in payment options.

- QuadPay: QuadPay is a leading player in the installment payments industry, allowing users to split their purchases into four equal installments over six weeks. With no credit checks or hidden fees, QuadPay appeals to many consumers seeking budget-friendly payment solutions.

- PayPal Pay in 4: PayPal’s Pay in 4 feature allows customers to divide their purchase amount into four equal payments over six weeks. This service combines convenience with trustworthiness since PayPal has long been established as a reliable online payment platform.

Conclusion

To wrap up our discussion on other companies like Afterpay, it’s clear that the buy-now-pay-later industry is thriving with numerous players entering the market. While Afterpay has established itself as a prominent leader in this space, there are several other notable companies worth considering. It’s important for consumers to evaluate their options carefully, considering factors such as merchant partnerships, interest rates (if applicable), available payment plans, and overall convenience. By doing so, they can make an informed decision that aligns with their financial goals. The buy-now-pay-later industry is expanding rapidly, offering consumers a variety of choices beyond Afterpay. Whether it’s Klarna’s global reach or QuadPay’s simplicity, each company brings its own unique approach to the table. Ultimately, finding the right fit depends on individual preferences and requirements. So, take your time to explore these alternatives and choose the one that best suits your needs. Happy shopping!