Every business owner wants to see their business flourish. Exploring new markets, adapting to technological advancements, adhering to evolving compliance standards, and managing various other factors present significant challenges.

Every business owner wants to see their business flourish. Exploring new markets, adapting to technological advancements, adhering to evolving compliance standards, and managing various other factors present significant challenges.

However, amidst these challenges, businesses must thrive and break free from the shackles of debt to achieve sustainable success. The complexities of managing business finance can be daunting, but with the right approach, it’s entirely possible to achieve financial independence and chart a path toward long-term prosperity.

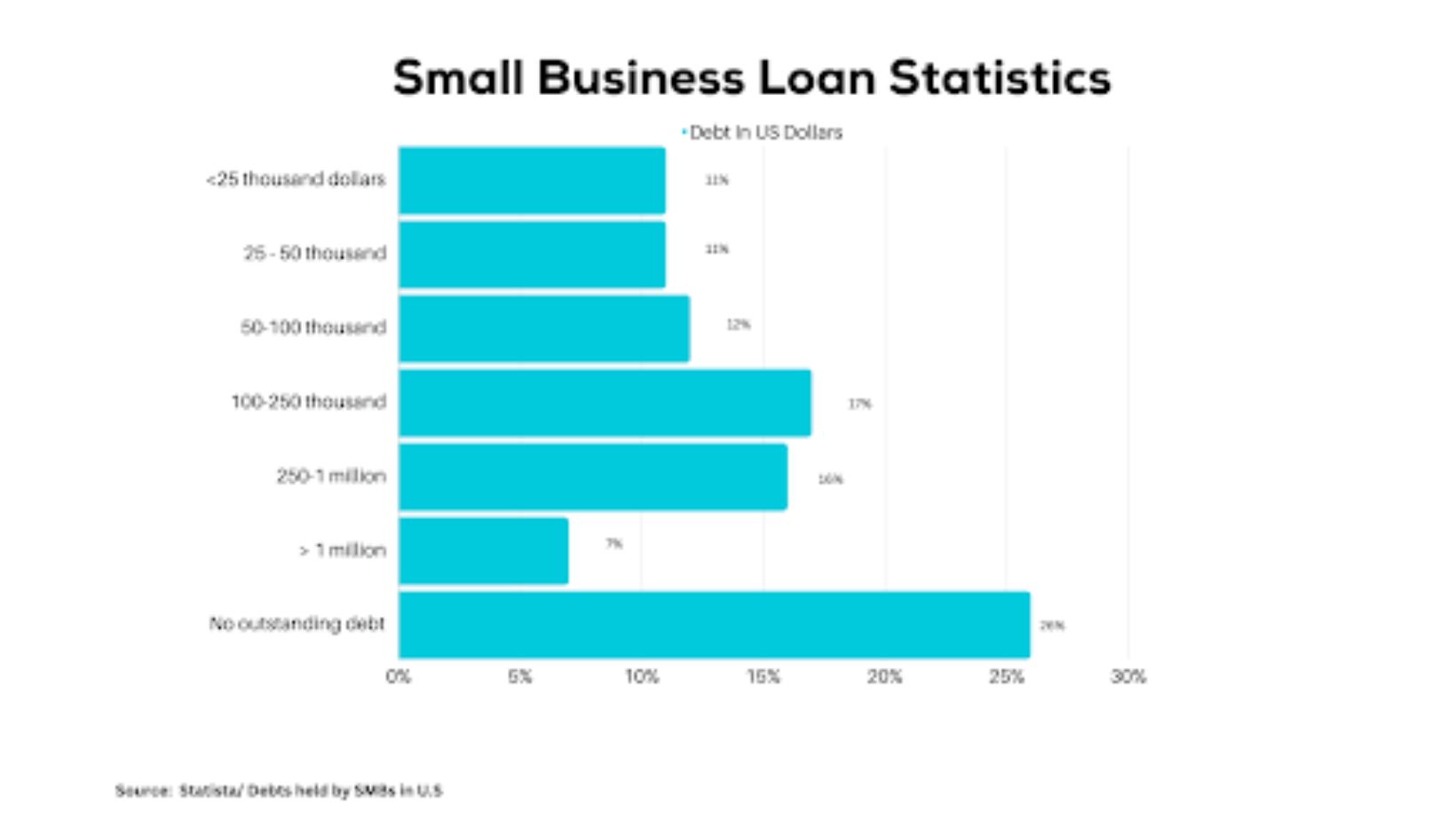

It’s no surprise that 73% of small businesses carry an average debt of $195,000, underscoring the prevalence and potential burden of debt on businesses. In this realm, the concept of debt-free freedom emerges as a beacon of financial strength and stability. This blog is a comprehensive guide, offering invaluable insights and practical strategies for businesses.

Assessing Financial Stability

Achieving financial stability is critical for any business to thrive in the long term. However, taking on too much debt can jeopardize that stability and leave companies vulnerable during economic downturns. According to industry analysis, businesses operating without debt have a much lower degree of risk and greater sustainability in the face of economic downturns. That’s why the concept of “debt-free freedom” has gained popularity, emphasizing financial discipline over rapid expansion.

Sacrificing rapid growth for a slower, organic business model ensures stability for years to come. Assessing a company’s current finances, establishing realistic budgets, building emergency savings, and exploring alternative financing options are all crucial steps on the path toward achieving debt-free freedom. Embracing sustainable growth strategies, diversifying revenue streams, and monitoring the numbers lays the groundwork for any enterprise to achieve financial independence.

Assessing the Current Financial Situation

Before setting out on the road to debt-free living, it’s vital for companies to fully understand their existing financial health. Conducting a comprehensive audit of all cash flows, assets, liabilities, profit margins, and potential risk areas provide that 360-degree view.

Software tools and professional auditors can assist with drilling down into specifics across departments to flag any inefficiencies or bottlenecks. This data then informs realistic budgets and growth forecasts across both short and long-term horizons.

The Economic State of Texas

In Texas, the economic situation is diverse, with significant contributions from industries such as energy, technology, agriculture, and manufacturing. While Texas has demonstrated resilience in the face of economic shocks, there are areas of concern, including potential budgetary pressures stemming from increased healthcare and social service costs, as well as volatility in energy markets.

Disparities in income and access to resources persist across different regions of the state, posing ongoing challenges for policymakers.

Overall, while Texas continues to navigate economic fluctuations, its robust economic fundamentals and proactive policy measures position it to weather challenges and pursue opportunities for sustainable growth.

As of August 31, 2023 Texas had a total of $70.94 billion in state debt outstanding, including both general obligation and revenue debt. A debt relief program would benefit individuals and families striving to break free from the shackles of financial hardship.

This innovative program, when tailored to the unique needs of Texans, would symbolize a commitment to economic empowerment and a brighter future for all. At its core, the debt relief pṣrogram recognizes the challenges faced by many Texans in managing their debts.

Additionally, Texas debt relief programs offer residents various options to manage and reduce their debts, such as debt consolidation, settlement, and counseling services, aimed at helping individuals regain financial stability.

Tracking Finances

Monitoring finances ensures both stability today and sustainability for the future – critical for protecting livelihoods and enabling companies to adapt to the evolving market climate.

Conducting a full financial audit is the first step to understanding profitability and risk areas across the company. This includes generating cash flow statements to review incomes and expenses by the department over recent financial quarters. Analyzing which divisions contribute the highest and lowest margins reveals where to target growth or cuts.

Forecasting future earnings based on current performance provides estimates for budgeting. Identifying potential weaknesses like fluctuations in raw materials costs or rising customer acquisition expenses enables strategic adaptations.

Audits summarize company valuation for investors, total addressable market size to inform expansion plans, and risks requiring contingency preparation.

Establishing a Realistic Budget

With current finances mapped, the next step is creating a realistic operating budget aligned with strategic business goals. What are the key investments or expenses needed to facilitate growth? How can waste be trimmed without negatively impacting daily operations? Establishing financial guardrails across procurement, payroll, inventory and more is essential.

That’s the reason 61% of small businesses with a budget are profitable. Getting lean in the right places provides an opportunity for innovation. And operating without the burden of debt payments enables businesses to weather any storm. With high finance rate influencing the profitability and affordability of financial transactions, freedom in finances influences business’ major decisions.

The sense of freedom and control over finances is invaluable during economic uncertainty. Setting clear budgetary guidelines and revisiting quarterly numbers also builds financial discipline across the organization.

With a clear picture of finances through audits, leaders can align tactical budgets to business goals for the upcoming fiscal year. Categorizing spending areas between essential, important, and nice-to-have guides prioritization – for example, keeping technology infrastructure investments on track while pausing non-critical hiring.

Building budgets by department also improves transparency on profitability across the organization. The finance team guides process improvements to enhance accuracy in forecasting and budgeting over time. Overarching measures also encourage company-wide participation – for example, offering bonuses for coming under budget on projects.

Building Emergency Funds

While a thorough budget accounts for most operating, investing, and financing flows, unexpected events can still threaten to derail progress. From minor equipment failures to major natural disasters, having accessible emergency funds is a pillar of debt-free living. Building liquid cash reserves equal to 6-12 months of average expenses protects against having to take on debt to stay afloat.

Emergency savings provide business leaders with a greater sense of security and confidence to take strategic risks critical for growth. Being debt-free also allows companies to spend, save, or invest money according to their priorities rather than repaying loans. Developing lean spending habits focused on needs versus wants combined with diligent savings builds resilience.

Emergency funds require layered cash reserves with clear policies on accessing capital under varying circumstances.

Core reserves cover 6 months of average operating expenses in case of revenue decline. Secondary reserves fuel growth needs like opening new locations before achieving profitability. Tertiary funds managed directly by leadership fuel major pivots or mergers.

Strategically investing a portion of reserves increases interest earnings so the funds self-grow each quarter. Locking a percentage of reserves for the longest duration ensures capital remains untouched, with additional liquidity built for nearer-term needs. Aligned access policies and transparency on total reserves reassure stakeholders of stability.

Exploring Alternative Financing Options

In reality, external funding is likely needed during a company’s journey to profitability and beyond. But instead of automatically pulling loans, creative alternative options better align with debt-free ideals. Government subsidies, grants, venture capital investors, and cash infusions from partners enable key investments while avoiding compounding interest or restrictive terms.

Crowdfunding campaigns also generate working capital directly from end consumers to fund new products or growth goals. Cryptocurrency innovations even allow companies to launch “initial coin offerings” tailored to their brands. Regardless of the specific financing path – as long as loan obligations are minimized or avoided entirely – the business retains control over its destiny.

Seeking investments that avoid taking on restrictive debt is key to funding growth and innovation initiatives. Equity financing partners purchase ownership shares with the potential for high returns tied directly to company performance.

Investors provide mentorship for improving operations too and may unlock access to broader business networks. Crowdfunding campaigns build awareness and loyalty while raising project capital from end consumers themselves.

Limited partnerships with external organizations also create strategic alignment – for example, co-owning a subsidiary spinoff company together to launch a new product line. Hybrid debt options like royalty financing provide funding similar to loans but with flexible repayment terms tied to actual sales revenue rather than rigid interest obligations. Evaluating collaborations, convertible notes, credit lines and more keeps financing aligned with operating realities.

Embracing Sustainable Growth Strategies

Financial discipline established, the next milestone on the road to debt-free freedom is fueling growth through sustainable strategies centered on generating organic demand. Tactics like boosting customer lifetime value through loyalty programs or pacing expansion into new markets protect profitability. Investing in process improvements, automation, and training boosts productivity without inflating expenses long-term.

Lean but steady gains preserve stability while progressing toward larger goals like geographic expansion or new product launches. Saying no to excessive risk that could prompt future bailouts prevents putting debt-free progress in jeopardy down the line. Sustainable growth allows companies to self-fund innovation cycles for years to come.

Sustainable growth requires balancing aggressive business development goals with financial discipline – expanding too fast or taking on excessive risk can quickly unravel progress instead of steadily building upon it over time.

Strategies like focusing on higher-margin products and upselling existing customers first maximize profitability before tapping more difficult markets. Small pilots minimize risk when launching new offerings before full rollout.

Investing in infrastructure and tools to increase productivity ultimately saves on expanding headcount. Providing financial incentives connected to bonus metrics also motivates staff to identify efficiency opportunities and support scalability. Pursuing environmental and community initiatives also attracts customer goodwill and referrals needed to sustain reasonable growth amidst cyclical economic changes.

Diversifying Revenue Streams

Relying too heavily on one set of customers, product offerings or markets leaves companies financially vulnerable. Economic volatility or disruptive competitors can threaten stability seemingly overnight. That’s why diversifying revenue streams is another pillar of the debt-free framework – if one area declines, other sources help carry the business through the dip.

According to a survey conducted by McKinsey & Company, businesses that successfully diversify their revenue streams increase their chances of outperforming their competitors by 20%.

Adding products, services, and experiences opens up access to entirely new demographics with cross-selling opportunities. Strategic partnerships also tap into third-party networks driving exposure and customer referrals.

Offering professional services, maintenance plans, and consultations creates reliable recurring revenue. With varied income deploying across divisions, the company collectively supports growth initiatives without debt dragging down individual departments.

Monitoring And Adjusting Financial Strategies

Amidst the daily pressures of running a business, leaders often neglect to stay on top of the numbers driving the highest-level strategy. But regularly reviewing budget versus actual performance and precisely adjusting based on any red flags or opportunities is imperative. Software dashboards centralize metrics for rapid decision-making to keep initiatives above water.

Bringing voice of the customer feedback into the mix also helps companies stay aligned with target audience needs even as market preferences evolve. Remaining agile and adapting to sustain profitability prevents having to take on destabilizing loans down the line. Recruiting outside financial expertise as strategic advisors also lends an objective perspective for occasional course corrections.

Debunking Myths About Business Debt

Addressing misconceptions head-on is crucial in navigating the complex terrain of business finance. It’s often assumed that taking on debt is synonymous with an inevitable path to bankruptcy.

However, delving deeper into the data reveals a more nuanced reality. There’s indeed a higher risk of bankruptcy associated with certain types of debt, this risk can be mitigated with informed financial strategies.

Understanding the real impact of debt on businesses allows us to debunk myths and embrace a more sustainable approach to financial management. By unraveling these misconceptions and shedding light on the true implications of debt, we pave the way for businesses to make informed decisions that align with their long-term goals and objectives. Let’s explore some common myths surrounding business debt and uncover the truths that lie beneath.

Conclusion

Achieving debt-free sustainability takes incredible discipline, leadership, and resilience – but the long-term payoff is invaluable freedom. Following the roadmap of assessing finances, budgeting diligently, saving for emergencies, and diversifying income sets any enterprise on the path to success on its terms.

At the same time, there may be some sacrificed pace, stable and secure prosperity year after year builds toward the ultimate goal: an organization poised to evolve consistently with no debt drag.

FAQs

1. How do you ensure the financial growth of your business?

To ensure financial growth, focus on increasing revenue streams, managing costs effectively, investing in marketing and innovation, and analyzing market trends to adapt strategies accordingly. Regular financial audits and leveraging data analytics can also help identify and capitalize on growth opportunities.

2. How do you create financial stability?

Financial stability is achieved through prudent financial management, maintaining a healthy cash flow, building a strong capital base, and diversifying income sources. It also involves risk management practices, such as having contingency plans and adequate insurance coverage to mitigate unforeseen losses.

3. How can a company improve its financial stability?

A company can improve its financial stability by reducing unnecessary expenses, improving operational efficiency, renegotiating debt terms, and focusing on high-margin products or services. Strengthening relationships with customers and suppliers to ensure consistent revenue and supply chain reliability is also crucial.

4. What helps a business thrive?

A thriving business consistently meets or exceeds customer expectations, adapts to market changes, and innovates. Building a strong brand, investing in employee development, and maintaining financial health are also key. Engaging with the community and stakeholders builds loyalty and support.

5. What are the major growth strategies?

Major growth strategies include market penetration, market development, product development, diversification, and acquisition. These strategies involve expanding market share, entering new markets, introducing new products, branching into new industries, or acquiring complementary businesses.

6. What’s the key to business growth?

The key to business growth lies in understanding customer needs, delivering exceptional value, and continuously innovating. Building a strong, adaptable team and maintaining robust financial health are also critical. Strategic partnerships and leveraging technology can accelerate growth.

7. How can I get money to grow my business?

Funding options for business growth include reinvesting profits, securing loans or lines of credit, finding investors, or issuing shares. Crowdfunding platforms and government grants are also viable sources, especially for startups and small businesses with innovative products or services.

8. What are the major sources of funds?

Major sources of funds for businesses include internal sources like profits, external debt financing from banks or financial institutions, equity financing from investors, and government grants. Crowdfunding and venture capital are also significant, especially for startups.

9. How do you manage a business that’s about to collapse?

To manage a business on the brink of collapse, critically assess the situation to identify root causes. Prioritize cash flow management, reduce costs, and consider restructuring debt. Communicate transparently with stakeholders and seek professional advice for possible turnaround strategies.

10. How do you attract more customers to your business?

Attracting more customers involves understanding their needs and preferences, delivering high-quality products or services, and engaging in effective marketing. Building a strong online presence, leveraging social media, and offering promotions or discounts can also draw in new customers. Personalized customer experiences create loyalty and word-of-mouth referrals.

11. Why should businesses aim for debt-free status?

- Achieving debt-free status provides businesses with greater financial flexibility and stability. If there is no burden of debt payments, companies can reinvest profits into growth initiatives, withstand economic downturns and maintain better control over their financial future.

12. What strategies can businesses employ to reduce or eliminate debt?

- By prioritizing debt repayment, negotiating with creditors for lower interest rates or extended payment terms, implementing cost-cutting measures, and generating additional revenue through diversification or increased sales.

13. How can businesses balance the need for growth with avoiding excessive debt?

- Businesses can adopt a strategic approach to financing by carefully evaluating investment opportunities, focusing on sustainable growth initiatives, leveraging equity financing, and maintaining a healthy cash flow to minimize reliance on borrowing.

14. What role does effective financial management play in achieving debt-free freedom?

- Effective financial management involves developing a comprehensive budget, closely monitoring cash flow, regularly reviewing financial statements, implementing efficient invoicing and collection processes, and seeking professional guidance when needed to optimize financial performance.

15. How can businesses adapt their financial strategies to navigate economic uncertainties?

- Businesses can navigate economic uncertainties by building up cash reserves, diversifying revenue streams to reduce reliance on any single source of income, maintaining a conservative approach to debt financing, and staying agile in responding to market fluctuations and emerging opportunities or challenges.