President Donald Trump’s announcement of major changes to U.S. tariff policy earlier this month sent markets into meltdown mode. The crypto market was no exception. Much like with major stocks, top cryptocurrencies have experienced a sudden drop in price.

Rates for cryptocurrency can be found on websites such as Binance. Searching there for the latest Bitcoin prices, one can clearly see how much tariff worries have weighed heavily on BTC prices, with the sell-off accelerating in more recent trading days.

Yet while Bitcoin has more-or-less trended similarly to the stock market since the tariff shock took shape on April 2, don’t rule out the potential for this recent news to ultimately serve as a positive catalyst for Bitcoin prices.

At least, that’s the view of one crypto analyst, who back in February first laid out this tariff-driven bull case for BTC.

There’s Substance to the Tariff-Driven Bull Case for Bitcoin

Bitcoin prices have fallen in response to recent tariffs that have escalated tensions between the U.S. and its largest trading partners, but this may be the prelude to another bull run for BTC, and possibly for altcoins as well.

This bullish argument, laid out by Bitwise analyst Jeff Park, hasn’t just recently been formulated.

Two months back, when the market was merely speculating about possible changes to U.S. tariff policy, Park presented his thesis,via an X.com social media post. While multiple crypto media sources have discussed Park’s thesis, admittedly many of them have discussed Park’s bull case too broadly.

Diving into the details, however, one can see how this bull case is substantive in nature, not just a weak argument quickly cooked up by cryptocurrency bulls. In a nutshell, the analyst believes that Trump’s decision to go hard on tariffs is all part of a plan to both lower interest rates, and to devalue the U.S. dollar.

If it all goes according to plan, the end result could prove painful for the U.S., but even more painful for America’s trading partners, with this pain possibly translating into tremendous gains for Bitcoin and other cryptocurrencies.

How Statecraft Could Drive the Next Crypto Rally

According to Park, Trump and his administration are trying to both reduce the trade deficit and devalue the dollar, all while maintaining America’s ability to borrow money at lower rates due to the reserve currency status of the U.S. Dollar.

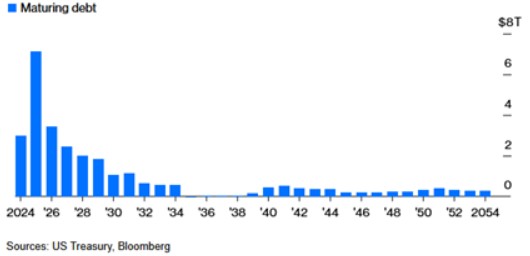

Why? Part of it has to do with issues such as trillions in upcoming debt maturities, which will be costly if refinanced at current interest rates, and part of it may have to do with the President’s personal financial interest.

The aggressive posturing on tariffs simply marks the start of possible negotiations with the U.S. and its trading partners that result in achieving these objectives. The administration will also likely continue to take actions that increase the likelihood of the Federal Reserve relenting on its cautious approach to rate cuts.

The end result? Higher prices for risk assets in U.S. dollar terms, and of course a resurgence in inflation. Again though, the consequences of tariffs could prove more damaging to America’s trade partners. According to Park, these countries will need to pursue inflationary monetary and economic policies, which in turn will weaken their currencies. This currency debasement will drive capital into alternatives like Bitcoin and other liquid cryptocurrencies.

Food for Thought as Tariffs Slam Crypto Prices

Park is not the only one propagating this theory. Others have laid out similar arguments. Not only that, take a look at the economic theories of Stephen ira Miran, the current head of the Council of Economic Advisers, and it’s clear that Trump is not pushing for aggressive tariffs on a whim.

Of course, while Park may be right about the motivations behind Trump’s policy changes, he could be jumping to conclusions when it comes to its potential impact on crypto prices. Still, in light of the “doom and gloom” out there, Park’s bull case is definitely food for thought, as investors figure out how to both reduce risk and capitalize on new opportunities in the current market environment.