Understanding the various payment methods available today is crucial in an increasingly digital world. From traditional cash transactions to the latest in cryptocurrency and blockchain technology, payment systems have evolved significantly. This guide provides an in-depth look at the diverse range of payment methods used today, their benefits, drawbacks, and future trends.

Traditional Payment Systems

Cash has been the cornerstone of transactions for centuries. Its use dates back to ancient civilizations, where coins and notes were the primary medium of exchange. One of the biggest advantages of using cash is its simplicity and universal acceptance. There are no transaction fees, and it provides a tangible way to manage money.

However, cash also has its drawbacks. It can be easily lost or stolen, and it lacks the convenience of digital transactions. Despite these disadvantages, cash remains relevant, especially in regions with limited access to digital infrastructure. It’s also favored for small, everyday purchases and by those who prefer to avoid electronic payment systems for privacy reasons.

Checks

Checks have been a significant part of the payment landscape since their introduction. They involve writing, endorsing, and processing, which can be time-consuming. The advantage of checks lies in their ability to facilitate large transactions without the need for physical cash.

However, the use of checks has declined due to the rise of faster, more convenient digital payment methods. Checks are prone to fraud and can incur processing delays. Despite this, they are still used in certain sectors, like real estate and business-to-business transactions, where electronic alternatives might not be as practical.

Digital and Electronic Payment Systems

Credit and debit cards revolutionized the way we handle money. These cards allow users to make transactions without carrying cash. Credit cards offer the added benefit of purchasing on credit, which means buying now and paying later. Debit cards, on the other hand, directly deduct funds from the user’s bank account.

The advantages of card payments include ease of use, widespread acceptance, and the ability to track expenses. However, they also come with risks, such as fraud and high interest rates on credit card balances. Despite these concerns, the use of cards continues to grow, driven by technological advancements like contactless payments and enhanced security features.

Online Banking and Transfers

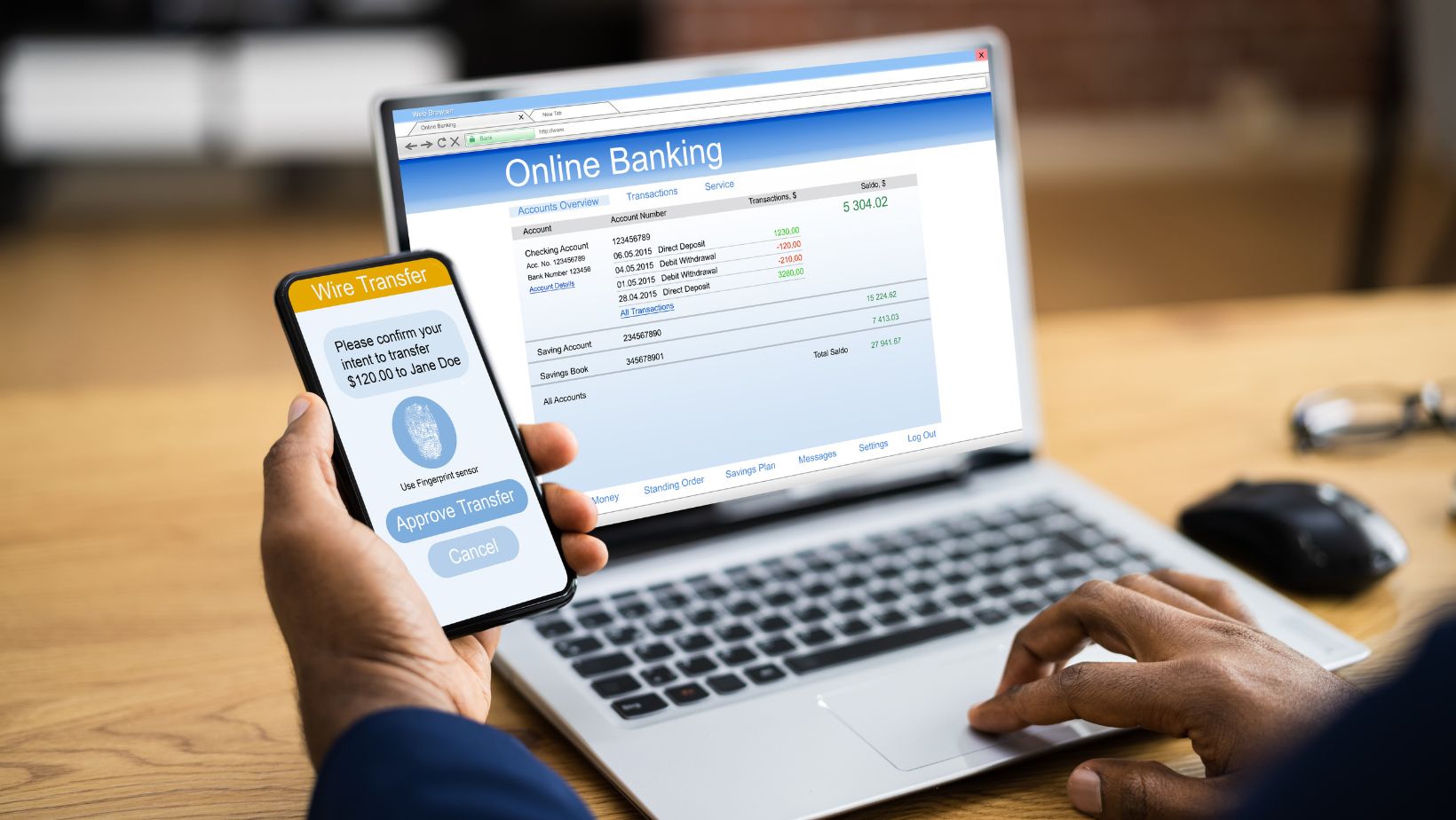

Online banking has transformed how we manage finances. It allows users to perform a variety of banking activities from the comfort of their homes, including transferring money, paying bills, and checking account balances. Electronic and wire transfers enable quick and secure movement of funds between accounts.

The main benefits of online banking are convenience and accessibility. Security measures, such as encryption and two-factor authentication, help protect users’ financial information. With more people embracing digital life, the popularity of online banking is set to rise, supported by ongoing technological advancements.

Mobile Payment Systems

Mobile wallets, like Apple Pay and Google Wallet, have become popular for their convenience and security. These digital wallets store payment information on a smartphone, allowing users to make transactions with a simple tap or scan.

Mobile wallets offer numerous benefits, including faster transactions and enhanced security through tokenization and biometric authentication. As more retailers adopt contactless payment systems, the use of mobile wallets is expected to grow, making them a staple in the modern payment ecosystem.

Peer-to-Peer Payment Apps

Peer-to-peer (P2P) payment apps such as Venmo, PayPal, and Zelle have simplified personal and small business transactions. These apps allow users to send and receive money instantly using their smartphones.

The main advantage of P2P apps is their ease of use. They facilitate quick payments without the need for cash or checks. However, users should be aware of potential security risks and transaction fees. P2P payment systems are becoming increasingly popular, especially among younger generations who value convenience and speed.

Advanced Payment Technologies

Contactless payment technology allows consumers to make payments by simply tapping their card or mobile device on a terminal. This method is quick and reduces physical contact, which has become particularly important during the COVID-19 pandemic.

Contactless payments offer speed, convenience, and improved hygiene. Encryption and fraud detection systems address security concerns. With increasing adoption, contactless payments are poised to become the standard for everyday transactions.

Biometric Payments

Biometric payments use physical characteristics, such as fingerprints or facial recognition, to authenticate transactions. This technology offers a high level of security and convenience, as it eliminates the need for passwords or PINs.

While biometric payments are still in their early stages, their potential is vast. They provide a seamless user experience and reduce the risk of fraud. As technology advances, biometric payments are expected to become more widespread, further enhancing the security and efficiency of digital transactions.

Conclusion

Understanding the wide array of payment systems available today—from traditional cash to cutting-edge cryptocurrency—is essential in navigating the modern financial landscape. As technology evolves, staying informed and adaptable will ensure businesses and consumers can leverage the most efficient and secure payment methods. For example, managing issues like a returned mobile ACH payment cona Capital One requires a thorough understanding of traditional and digital banking processes.